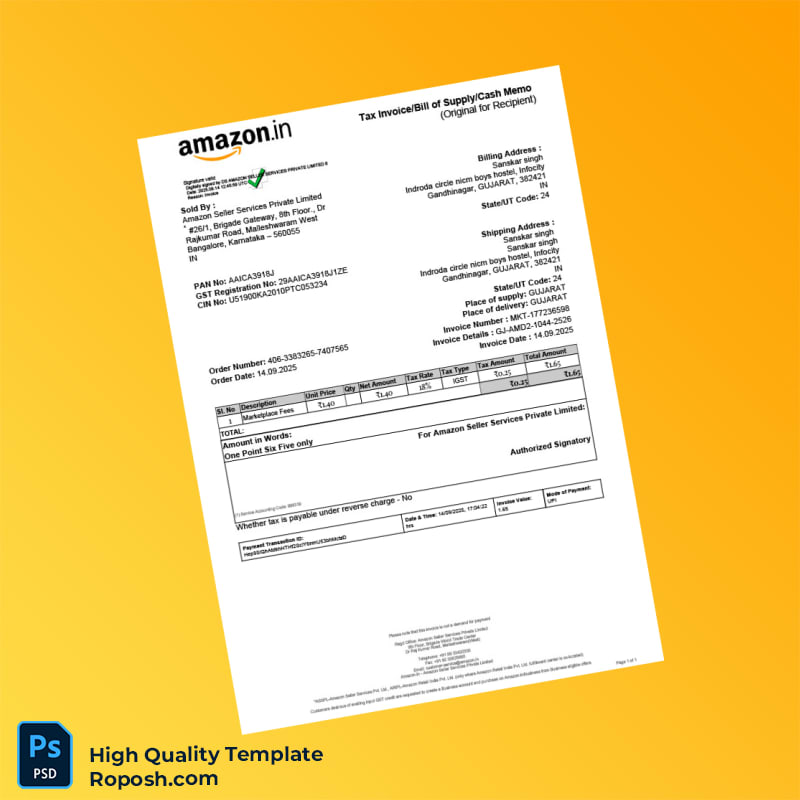

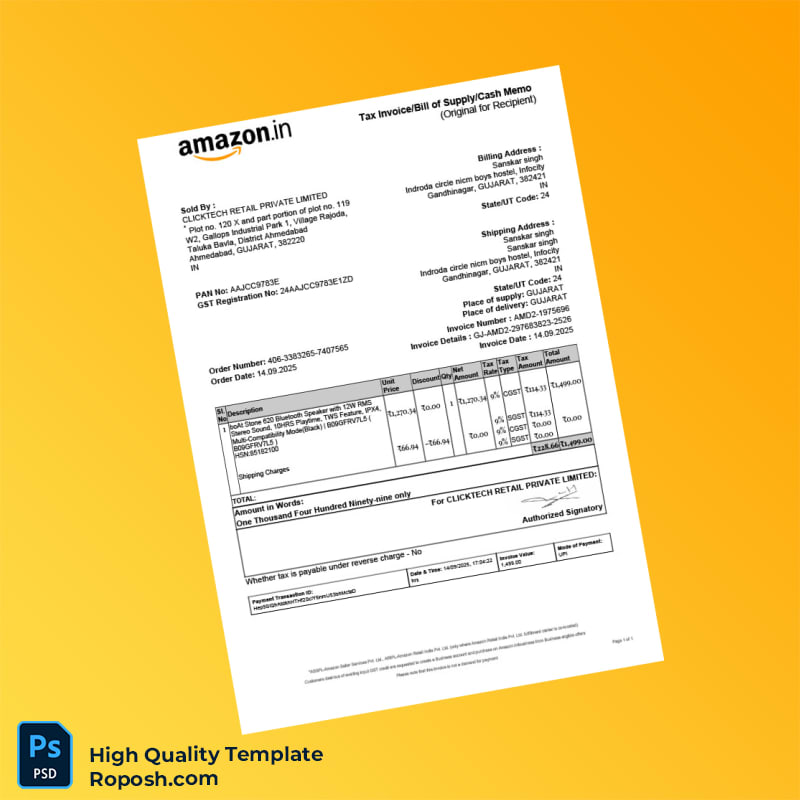

India Amazon Seller Services Invoice Template in Word and PDF Formats

Streamline your billing process with the India Amazon Seller Services Invoice Template by India Clicktech Retail Private Limited. This editable blank invoice template comes in both Word and PDF formats, designed for sellers and professionals who demand accuracy, compliance, and ease of use in their invoicing documents.

For any business dealing with multiple invoices, having access to a reliable and customizable invoice template is essential. Imagine a seller who recently lost their original invoice template but needed to generate tax invoices immediately to meet Amazon’s compliance requirements in India. By choosing this editable invoice template, they swiftly recreated professional invoices without hassle, saving time and avoiding disruptions in their sales reporting.

Key Features of the Editable Invoice Template

Easily Customizable for Accurate Billing

All details such as company name, recipient address, invoice number, and tax details are fully editable, enabling you to tailor every document precisely to your business needs. This customization ensures you maintain professional standards and stay compliant with tax regulations.

High-Quality Word and PDF Formats

Enjoy the flexibility of both editable invoice template Word and editable invoice template PDF versions. Whether you prefer to make on-the-fly edits using Word or require a polished printable version with PDF, this template covers all needs.

Instant Download & Ready for Use

Upon purchase, the template is immediately available for download, which means there is no waiting time. This is perfect for professionals who need quick replacements or updated invoice templates without delay.

Designed for Professional Printing and Digital Sharing

The high-resolution layout guarantees that printed invoices look sharp and official, while digital versions maintain formatting integrity across devices.

Includes All Necessary Fonts and Formatting

Save time on formatting with fonts and styles embedded to produce a clean, consistent professional look across all invoices.

Why Choose This Template for Your Business?

This template is perfect for Amazon sellers in India and other professionals needing an editable invoice template word that meets stringent tax invoice standards. It solves common pain points like lost invoice templates, the frustration of non-editable documents, and compliance concerns by providing a dependable, easy-to-edit resource.

For those operating in other markets or sectors, consider checking out related invoice templates like the USA Amazon Invoice Template or the thoroughly structured High-Quality Australia ABOL Marketing Consultancy Company Invoice for a tailored invoicing experience.

Get Started With Professional Invoices Now

Empower your invoicing process with the India Amazon Seller Services Invoice Template. Download your editable printable invoice template today and ensure flawless, efficient billing for your business needs.

Reviews

There are no reviews yet.