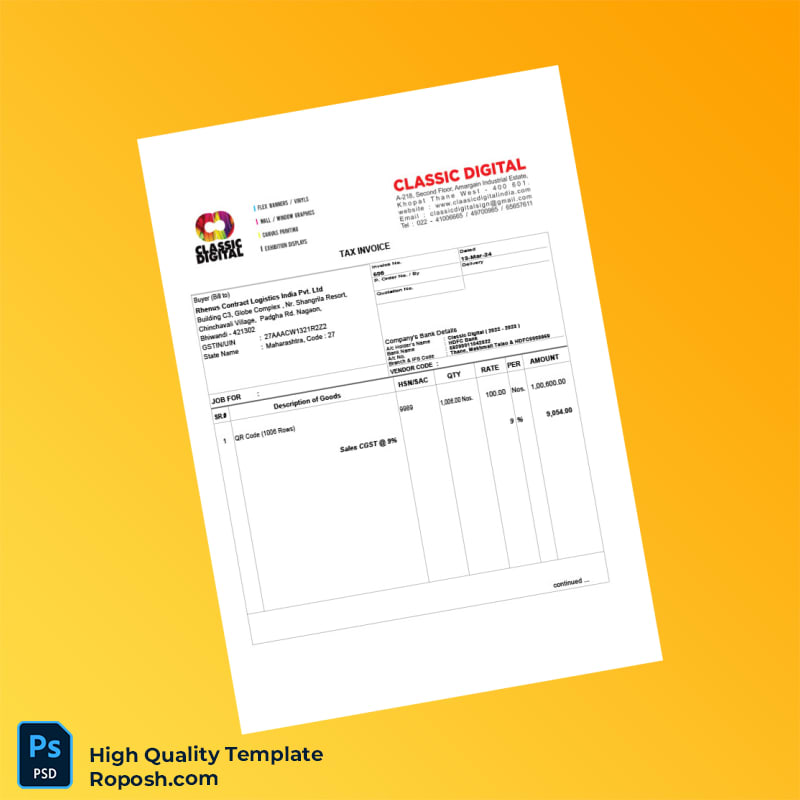

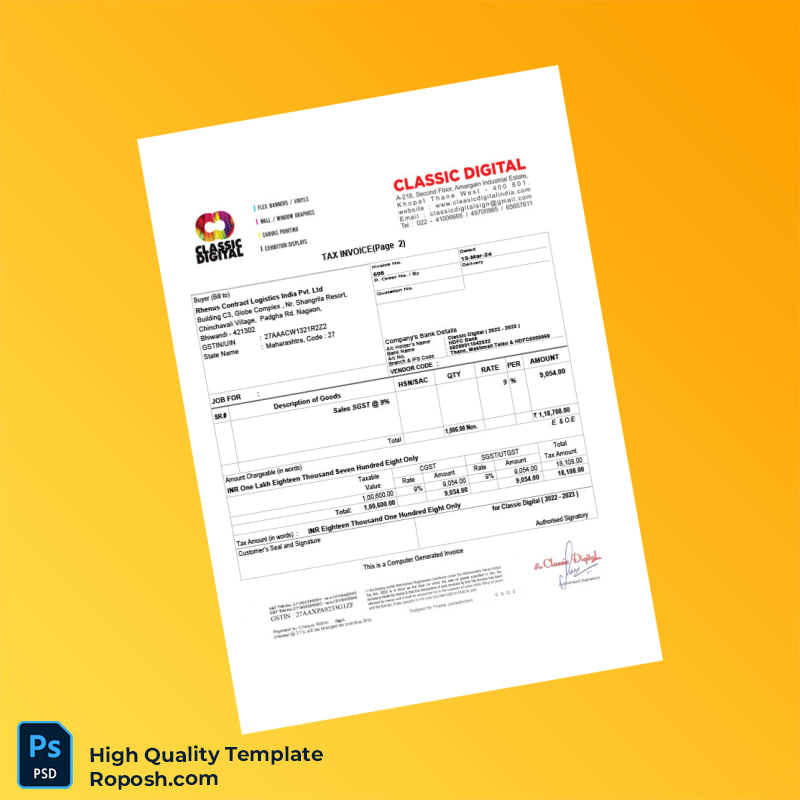

India Classic Digital Tax Invoice Template: Streamline Your Invoicing Process

The India Classic Digital Tax Invoice Template, available in Word and PDF formats, offers a seamless solution for professionals who require a customizable, reliable, and legally compliant invoice. Designed for quick editing and professional presentation, this editable invoice template simplifies your billing workflow and ensures accuracy every time.

Understanding the Needs of Busy Professionals

For freelancers, small business owners, and accountants in India, the challenge often lies in generating error-free invoices swiftly while maintaining compliance with tax regulations. Imagine a consultant who recently lost their original invoice files and needed an immediate replacement to avoid payment delays. By leveraging this editable invoice template, they restored their invoicing system instantly with no compromise on quality or detail.

Industry-Specific Keywords

editable printable invoice template, blank editable invoice template, editing invoice template, invoice word template, blank template in word

Key Features and Benefits

- Easily edit all document details including client information, dates, and amounts for precision and flexibility

- High-resolution, print-ready format ensuring professional presentation in both Word and PDF versions

- Includes all necessary fonts embedded to maintain consistent layout and branding

- Instant download after payment confirmation for immediate use and convenience

- Compliant with Indian taxation standards, reducing risk of billing errors

- User-friendly interface ideal for both beginners and experienced professionals

- Designed to be fully printable or digitally savable, supporting various business needs

Addressing Core Professional Challenges

This template directly resolves critical pain points by:

- Eliminating delays caused by lost or outdated invoice files through immediate availability

- Reducing human errors during invoice creation by providing a clear, editable structure

- Supporting tax compliance with a design tailored to Indian standards, removing guesswork from invoice preparation

Enhance Your Invoicing with Premium Templates

For professionals looking to diversify their template library, exploring related solutions such as the High-Quality India Cemiti Sports Electronic Community Invoice and the High-Quality India Demo Pharma Distributor Medicine Consultancy Services Invoice can expand your invoicing versatility across industries. Each template shares the hallmark of easy editing and professional formatting, building a robust invoicing toolkit tailored to your specific field.

Ready to Simplify Your Billing?

Don’t let complex or missing invoices disrupt your business flow. Harness the power of the India Classic Digital Tax Invoice Template to deliver precise, professional invoices every single time. Purchase now and benefit from the efficiency and reliability that comes with this expertly crafted editable invoice template. Start customizing your invoice today and take control of your financial documentation with ease.

Reviews

There are no reviews yet.